Connect With Us

Theoretically, invoice financing is one of the best forms of short-term financing for both businesses and financing institutions. It is one of the easiest ways to solve cash-flow problems for a business. That’s how every business can grow and utilize its actual potential. This serves the economy-related goals of sustainable development by the United Nations.

Before moving further we need to take a look at the basics

United Nations’ Sustainable Development Goals (SDGs)

The Sustainable Development Goals (SDGs) is a collection of 17 interlinked global goals set up by the United Nations General Assembly (UNGA) in 2015. These goals are considered a “blueprint to achieve a better and more sustainable future for all”. The UN member states are committed to achieving all these goals by 2030.

The United Nations Conference on Sustainable Development (Rio+20 Summit) held in 2012 was a major step toward setting the global goals of sustainable development. By 2015 the UNGA was able to define these goals.

The Sustainable Development Goals (SDGs) are meant to address all three aspects of long-term development. (environmental, economic, and social) . More about can be found here on the UN website.

Invoice Financing

Invoice Financing is a kind of short-term financing that a business can get against its receivable invoices (Accounts Receiveable). The basic purpose of invoice financing is to improve the business’ cash flows by being able to utilize the amount at present which is yet to be received in the future.

The invoice financing works in the following way;

A business/individual sells goods or services to others against some future payment commitment ( like 15 or 30 days from the actual transaction) and generates the invoice for the same. Now that the business has blocked the amount and can’t use it until it gets paid. When the number of credit invoices increases, the business irrespective of its size and volume starts facing a cash flow crunch. The business then goes to a financial/lending entity (individual or organization) and asks them to provide short-term financing against these invoices. The lender then verifies and validates these invoices and issues an amount (usually lesser than the actual amount of the invoices) to the borrower (the business) for a mutually agreed upon period). The period is determined according to the invoice due dates. Once the invoice becomes due the business collects that amount and pays the due amount plus agreed-upon service charges to the lender.

Challenges of Invoice Financing

On paper, invoice financing suits both, the business and the lender. The business overcomes its cash flow problem and utilizes that amount to earn more profit and achieve more sustainability. On the other hand, the lender or financing institution gets the security it needs to extend the credit facility to the business. With these advantages and the ease of mechanism, invoice financing should be among the most desirable financing solutions for borrowers and lenders but that’s not the real scenario.

The estimated size of the commercial lending market in 2022 is $7,833.88 billion whereas the invoice financing/factoring market size stands estimated at USD 3,566.99 billion for the year 2022. The figure looks good but that is mainly due to the large businesses. The invoice financing market for MSMEs and especially that of small businesses remains underdeveloped and untapped largely.

Small and medium enterprises make up 90% of the global business and employ 50% of the workforce worldwide. In emerging economies, SMEs contribute more than 40% of the GDP. At the same time, in emerging markets, 7 out of 10 jobs are created by SMEs. All these figures show the importance of SMEs in the global economy in general and in the emerging economies in particular. The dilemma of SMEs is that most of them don’t have access to any formal financing. This way these businesses can hardly take full advantage of their actual potential. There are multiple reasons for this deprivation of credit facilities but to sum up it can be said that due to the unavailability of formal documentation as well as lack of capital assets, the financial institutions don’t extend financing facilities to SMEs. This way SMEs can’t properly contribute to the global economy thus depriving a large number of the population of achieving the sustainable development goals. This not only impedes national development but also leads to less employment and consequently deprives a large population of jobs. This is against the spirit of UN SGDs.

Solution

The biggest hurdle for small and medium informal businesses is that they don’t have large capital assets like buildings, plants, and machinery so they don’t qualify for business financing. To solve their cash flow problems, they can use their account receivables (invoices) for the liquidation but they lack proper and reliable documentation. As banks and other financial institutions can’t verify the invoices provided by informal businesses so they consider them to be insecure for financing purposes.

This is where technology can make things better, Blockchain provides a trust mechanism that can replace the traditional requirements of secure financing. The immutable (tamper-proof) record-keeping on the blockchain can provide the required assurance of authenticity to the lending entity. This way small and informal businesses as well as individuals doing businesses can get their invoices financed. This financing can create a lot of new opportunities for the expansion of business and employment base. This way the goals of sustainable development and inclusion become much more accessible than before.

InvoiceMate

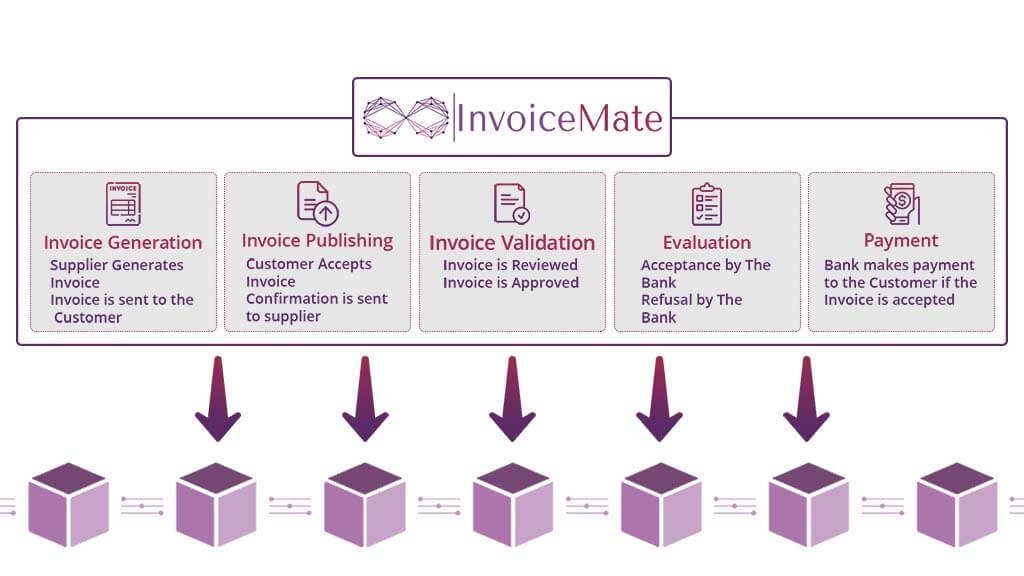

InvoiceMate is the world’s first blockchain-based complete invoice management system that covers the whole journey of invoice (from invoice creation to invoice payment including invoice financing) on blockchain making it immutable, resilient, and trustable. A duly time-stamped and transparent invoice record allows lending institutions to verify and validate the invoices of an informal or semi-formal business which was not possible otherwise. InvoiceMate offers the most unique concept for the enablement of secure invoice financing namely “Know Your Invoice”.

With “Know your invoice” all the relevant parties can always access and verify the invoice-related record. With every step of the invoice processing journey being directly recorded on the blockchain, no record can be deleted or updated with the original. Every change to the data will be recorded as a new version of the transaction without affecting the previous versions of the same transaction. This way you can always be sure of the authenticity of the data at any given time.

The Blockchain-powered InvoiceMate helps reduce documentation-related costs for small and medium businesses. The easier access to financing facilities can help small and medium businesses to unlock their full potential and increase productivity while creating more employment opportunities. This leads to greater financial inclusion of the population of emerging and under-developed economies. A more portion of the population getting access to economic activities means greater financial inclusion of individuals and more sustainable economic growth for the larger population of the world. This is the true spirit behind United Nations’ sustainable development goals for the world.

To learn more about InvoiceMate and how blockchain can resolve the trust issues, visit

https://www.invoicemate.net/invoice-management-system-blogs/

or write us at mate@invoicemate.net