Connect With Us

How InvoiceMate Enables Financial Inclusion in Africa

The article covers how InvoiceMate enables financial inclusion in Africa that can contribute to the Sustainable Development Goals of the UN. Let’s dive into some basics of the African economy in general and the present state and the future of the financing sector in Africa with a special focus on invoice financing.

African Economy Outlook

The continent of Africa is divided into five sub-regions by the UN, those are as follows

North, West, Central, East, and South Africa.

The African economy has been performing well lately but as with the rest of the world, the pandemic and the Ukraine-Russia conflict have hampered the growth in Africa as well. Still, Africa is the home of almost half of the world’s fastest-growing economies. Lately, the economy of some African countries has seen tremendous growth but overall, the African economy is still lagging behind the rest of the continents. Presently, Out of the top 100 economies in terms of GDP, there are 16 African countries. Africa is the 2nd smallest continental economy in terms of nominal GDP, only after Oceania. In terms of PPP, It is 3rd smallest continental economy after Oceania and South America. It accounts for only 4.97% of global wealth. As compared to the size and population of Arica this is still not a good number. Considering the fact that Africa is the second largest continent in the world, these numbers are not impressive. Still, what these numbers fail to depict is the actual economic potential of African countries.

Africa is a continent with great opportunities but most of those are still untapped. The continent is rich in natural resources. Africa has the 2nd longest coastline after Asia. It has the longest river in the world Nile.

In 2013, Africa was declared the poorest continent of the world but in the same year, it was the fastest growing continent in terms of economy with a 5.6% growth rate. The World Bank expects that with the current pace of the economy, most African countries would be able to achieve middle income by 2025 Africa’s real GDP growth is estimated at 6.9 percent in 2021, a strong recovery from the contraction of 1.6 percent in 2020 due to pandemic. North Africa had the highest growth (11.7 percent) whereas East Africa (4.8 percent).

According to the statistics for FY2021, the overall size of the African economy was recorded as US$2.7 trillion. The sub-division is as follows. The highest number is Northern Africa region which is $792 bn, closely followed by Western Africa ($777 bn). The two regions contribute about 58% of the African economy whereas 16.79% of the African GDP is distributed in Southern Africa, 16.44% in Eastern Africa, and 8.04% in Middle Africa.

Financial Sector in Africa

The financial sector in Africa is still under-developed as compared to the rest of the world. Even within the continent, it is highly diverse according to the regional economies. As a country, South Africa has the most-developed financial market but regionally North Africa is ahead of the rest of the continent. Johannesburg Stock Exchange in South Africa is among the top 20 stock exchanges in the world. South Africa also owns the most developed banking sector among all African countries. Approximately 43% of the total adult population of Africa has some access to formal banking.

Financially Africa is often classified into two regions, Sub-Saharan Africa SSA and North Africa. Sub-Saharan Africa has a diversified financial market with multiple influences from the world. On the other hand, North Africa is more closely tied with the Middle East traditionally. The region is collectively known as MENA (Middle East & North Africa). Markets in North Africa are influenced by Middle Eastern trends due to their historic cultural ties.

Financing Industry in Africa

Like other areas, the financing industry is also under-developed as of yet. Though the potential and the growth both are very promising, there is a lot to do. Although Africa’s banking market is the second-fastest in terms of growth, and the second-most profitable still the access to financing by businesses is still low as compared to international standards.

Financing Access for MSMEs in Africa

Africa has the highest access gap for financing in the whole world. More than 88% of the informal business/MSMEs have no access to financing. Almost half of the formal SMEs don’t have access to formal credit. The SME sector In Africa provides an estimated 80 percent of jobs to the continent. There are more than 44 million micro, small, and medium enterprises alone in Sub-Saharan Africa. Overall MSMEs make up more than 90% of the business in Africa. The MSME sector is very vital to the African economy and employment market. More than 51% of these businesses require financing to work to their fullest potential.

Invoice Financing

Invoice financing is a type of short-term borrowing where the borrower gets financed against its receivable invoices (accounts receivable). The lender issues a part of the receivable amount to the borrower instantly. This way borrower can utilize the amount to maintain proper cash flow resulting in more productivity. Upon receiving the payment against these invoices the account is settled with the lender.

The Problem

MSMEs despite being a vital sector for the economy are deprived of formal financing mainly for two reasons.

- Lack of Physical and Capital Assets

- Lack of proper and trustable business documentation

As banks and financing institutions don’t consider the informal documentation (Invoices) of MSMEs so they do not extend financing facilities to those.

The Solution

If MSMEs or informal businesses can produce trustable documents with the banks and other lending institutions, they can get entertained with credit. Blockchain technology provides a trust mechanism to answer the requirements of secure financing. The immutable (tamper-proof) record-keeping on the blockchain provides the required assurance of authenticity to the lending entity.

InvoiceMate

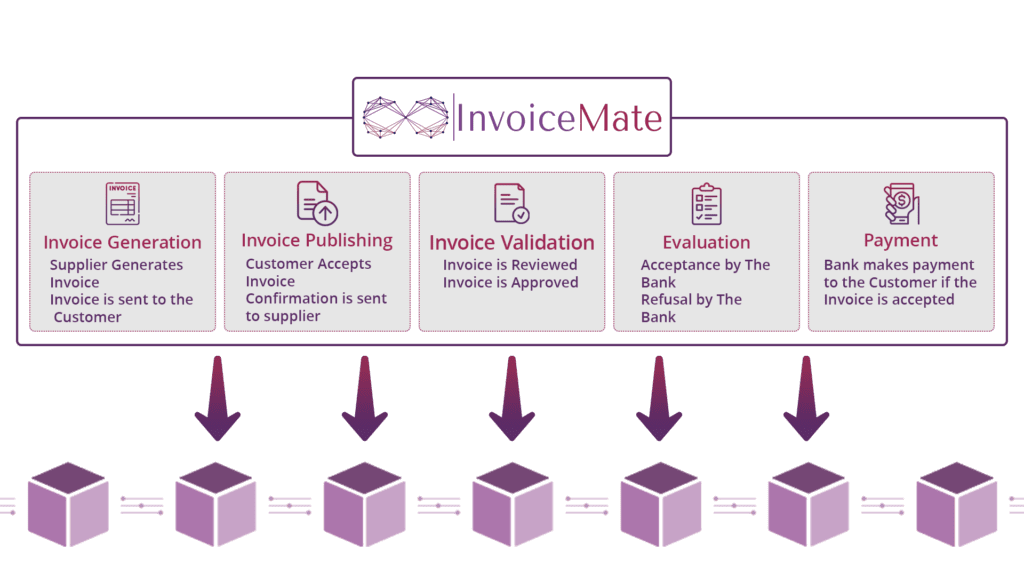

InvoiceMate is the world’s first blockchain-based complete invoice management system that covers the whole journey of invoice (from creation to invoice payment) on blockchain making it immutable, resilient, and trustable. A time-stamped, transparent invoice record allows financing institutions to verify and validate the invoices of an informal or semi-formal business which was not possible otherwise.

With the “Know your invoice” feature of InvoiceMate, all the relevant parties have access to verify the invoice-related record. As every step of the invoice processing journey is directly recorded on the blockchain, no record can be deleted or replaced with the original. Every change to the data will be recorded as a new version of the transaction while the previous versions of the same transaction remain there. This way the authenticity of the data is always ensured.

This way Blockchain-powered InvoiceMate can make it possible for the MSMEs and informal businesses to seek invoice financing with confidence. The lending institution can also trust these invoices due to the inherent trust mechanism. Access to financing facilities can help small and medium businesses in Africa to work with their actual potential, thus increasing productivity and creating more employment for the continent. This financial inclusion of the greater segment can lead to more sustainable economic growth. This is the true spirit behind United Nations’ sustainable development goals for the world.

More about InvoiceMate can be found here.

or write us at mate@invoicemate.net