Connect With Us

InvoiceMate for Financial Inclusion in Pakistan

Financial inclusion is one of the greatest challenges faced by the global economy in general and emerging economies like Pakistan in particular. In the following lines, we will take a look at how InvoiceMate acts as an enabler for financial inclusion in Pakistan through invoice financing.

Before moving forward let’s take a look at what financial inclusion is and the obstacles in the way of financial inclusion with special reference to economies like Pakistan.

Financial Inclusion

According to the World Bank, Financial inclusion means that individuals and businesses have access to useful and affordable financial products and services that meet their needs – transactions, payments, savings, credit, and insurance – delivered responsibly and sustainably.

Financial inclusion is one of the most important elements of the United Nation’s Sustainable Development Goals (Commonly known as UNSDGs). The World Bank’s report further mentions that;

- Financial inclusion has been identified as an enabler for 7 of the 17 Sustainable Development Goals.

- The G20 committed to advancing financial inclusion worldwide and reaffirmed its commitment to implement the G20 High-Level Principles for Digital Financial Inclusion.

- The World Bank Group considers financial inclusion a key enabler to reduce extreme poverty and boost shared prosperity.

Access to Banks is considered the gateway to financial inclusion. Having an account opens the door to other financial services leading to financial inclusion.

In emerging, developing, and underdeveloped economies, the challenges of financial inclusion are much bigger than those in developed economies. Multiple reasons contribute to the slower rate of financial inclusion in these markets. Poverty, Illiteracy, urban-rural disparity, lack of formal identification documents, and gender discrimination can be sought as major reasons behind this slower rate of financial inclusion.

Financial Inclusion Situation in Pakistan

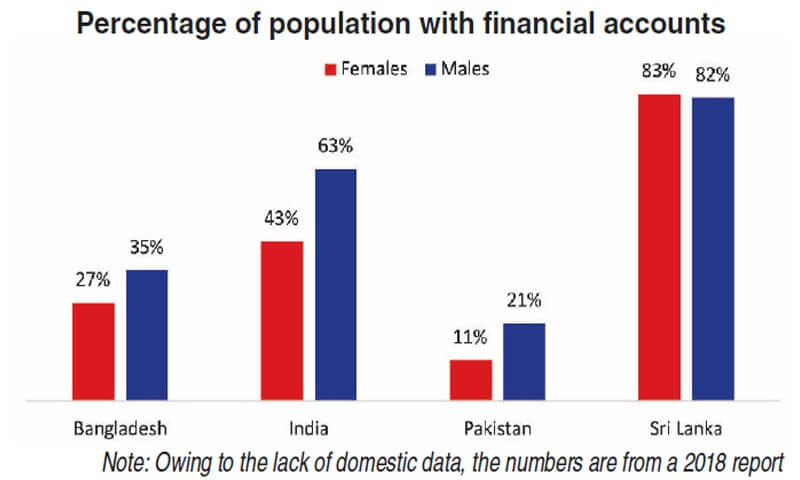

When it comes to financial inclusion in South Asia, Pakistan has the worst numbers in the whole region. This is for both males and females. According to the available data, about 8 out of 10 women in Pakistan do not have access to a bank account.

The above statistics show that Pakistan is badly lagging in financial inclusion. Almost all the factors discussed above as hurdles to financial inclusion are easily identifiable in Pakistan.

- Pakistan has high illiteracy and poverty rates

- Most of the population lives in rural areas with no or low access to businesses and financial services

- The highest gender discrimination ratio in access to financial services and employment across the region

- The majority of the businesses are either informal or small thus having a low documentation rate

Invoice Financing and Financial Inclusion

In emerging, and developing economies like Pakistan, the MSME sector plays a vital contribution to the overall economy. According to the data, MSMEs make up more than 90% of all businesses operating across the country. SMEs employ 80% of the non-agricultural labor force. MSMEs’ share in Pakistan’s annual GDP is 40%. They approximately constitute 25% of export earnings. In Pakistan, an enterprise is defined as an ‘SME’ if it consists of up to 250 full-time employees, paid up capital of up to PKR 25 million, and generates annual sales of up to PKR 250 million.

Considering the above statistics, MSMEs need to have access to formal financing facilities to effectively contribute to the economy. With more business opportunities this sector can provide more employment leading to greater financial inclusion. This financial inclusion makes the United Nation’s sustainable goals of development more accessible.

Unlike bigger businesses, MSMEs lack the resources to get adequate financing. They don’t have enough capital assets to secure financing facilities.

Considering these factors, invoice financing can be an ideal financing solution for MSMEs. Unlike other financing options where the business utilizes its capital assets as collateral, invoice financing can be sought against receivable accounts.

More about Invoice Financing & Invoice Factoring can be found here

For invoice financing, the business/individual needs to establish their invoice as valid collateral for financing. This is not possible with MSMEs and individuals doing small-scale business as unlike limited companies, their accounts and related documents are not subject to verification and validation by 3rd party auditors. An unverified invoice can be prone to multiple types of fraud and misrepresentation.

Some of the major possibilities of invoice financing frauds and issues are as follows

- False and Fake invoices. (Also known as thin air invoices)

- Duplicate Invoices

- Hidden disputes (Discounts, Settlements, Goods Return)

- Errors and Omissions (Intentional or unintentional)

- Collusion

- Re-Ageing

The risk of these types of invoice fraud can only be minimized with proper due diligence. The due diligence for invoice financing requires establishing the authenticity and integrity of the following three

- The seller

- The buyer

- The Collateral (Invoice)

This makes the due diligence for invoice financing tedious, lengthy and costly. As the nature of invoice financing is short-term, it becomes inviable for the financing institution to invest time and money into it. Due to this banks and other financing institutions don’t entertain invoice financing requests from MSMEs and informal businesses. This makes a large number of businesses deprived of access to financing. This refusal of access to finance leads to lower business volume and lesser employment opportunities.

InvoiceMate and The Invoice Financing

InvoiceMate is the world’s first blockchain-powered invoice management system. InvoiceMate offers trust, transparency, and efficiency at every stage of invoice processing, from procurement to payment as well as invoice financing. By deploying the inherent trust and transparency features of blockchain, InvoiceMate enables all the concerned parties to independently validate the integrity of the transactions.

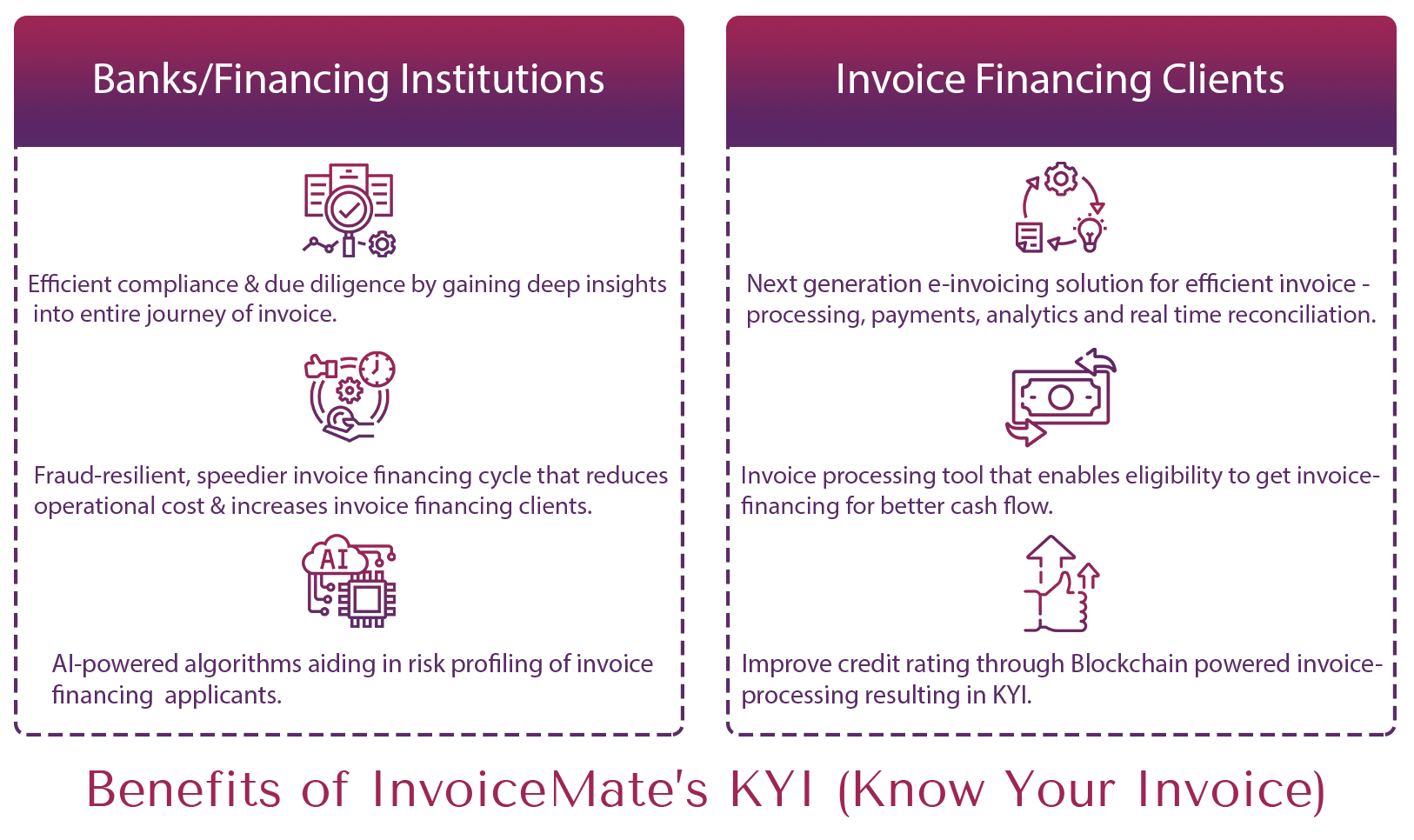

InvoiceMate provides a unique solution for invoice financing. This revolutionary solution is called KYI (Know Your Invoice). This unique service is equally beneficial for an invoice financing client as well as invoice financing institutions. KYI is offered to financing institutions as a compliance service just like the well-known financial service KYC (Know your customer/client).

With KYI even the smallest scale businesses or even sole proprietors can maintain a verifiable record of their transactions. This record is always verifiable by third parties like banks and financial institutions in real time. With this, MSMEs can seek invoice financing based on their accounts receivable as collateral. This way they can get good opportunities to take their business to their full potential as well as offer greater employment opportunities leading to financial inclusion for a major portion of a country’s population. This is exactly in line with the United Nation’s Sustainable Development Goals.

With KYI, financing institutions can get speedier compliance for invoice financing without involving lots of valuable resources like time and money.

In an economy like Pakistan, invoice financing can be a great way to accelerate the process of financial inclusion. InvoiceMate brings great new opportunities for MSMEs, informal businesses, and banks/financial institutions by enabling the seamless invoice financing process.

More about InvoiceMate’s KYI can be found here

To learn more about InvoiceMate please visit invoicemate.net

For a demo of the product, please feel free to write us at: mate@invoicemate.net